June 2025 Newsletter

What’s New This Month: Smiles, Dads, and Summer Sunshine

June brings longer days, warm weather, and the perfect excuse to slow down and reconnect with what matters most our health, our families, and the support systems we trust. At Crawford Benefits, we’re embracing this season with a mix of celebration and education. From health awareness to personal milestones, this issue highlights meaningful topics that affect the lives of the people we serve.

In this edition, you’ll find updates on Oral Health Month, an exciting new video series explaining the ins and outs of Life Insurance, and a special Father’s Day spotlight on our incredible team. We’ve also included a friendly reminder to report any income changes that could impact your tax credits, and to top things off, we’ve picked two refreshing summer recipes you can easily try at home. There’s something in this month’s issue for everyone take a few minutes and enjoy.

Oral Health Month: A Healthy Smile Starts with Coverage

Taking care of your teeth isn’t just about looking good it’s a crucial part of staying healthy overall. June is Oral Health Month, and that means it’s a great time to take stock of your dental coverage and schedule those regular checkups. Early detection of cavities, gum disease, and other dental issues can save you time, money, and discomfort in the long run.

Having active dental benefits ensures you can access cleanings, exams, and preventive care without breaking the bank. If you’re unsure whether your current plan includes dental coverage or if you’re looking for an affordable option, we’re here to help. Our team can walk you through your choices and make sure you’re set up with a plan that fits your needs and budget.

Now Playing: Life Insurance Video Series

We just launched a new video series that breaks down the basics of Life Insurance in a clear, simple way. Whether you're new to life insurance or just want a refresher, this series can help you understand what coverage you may need and why it matters.

Continue the series:

Understanding Term Life Insurance

Understanding Universal Life Insurance

Have questions after watching? We’re happy to talk through your options and help you find the right fit.

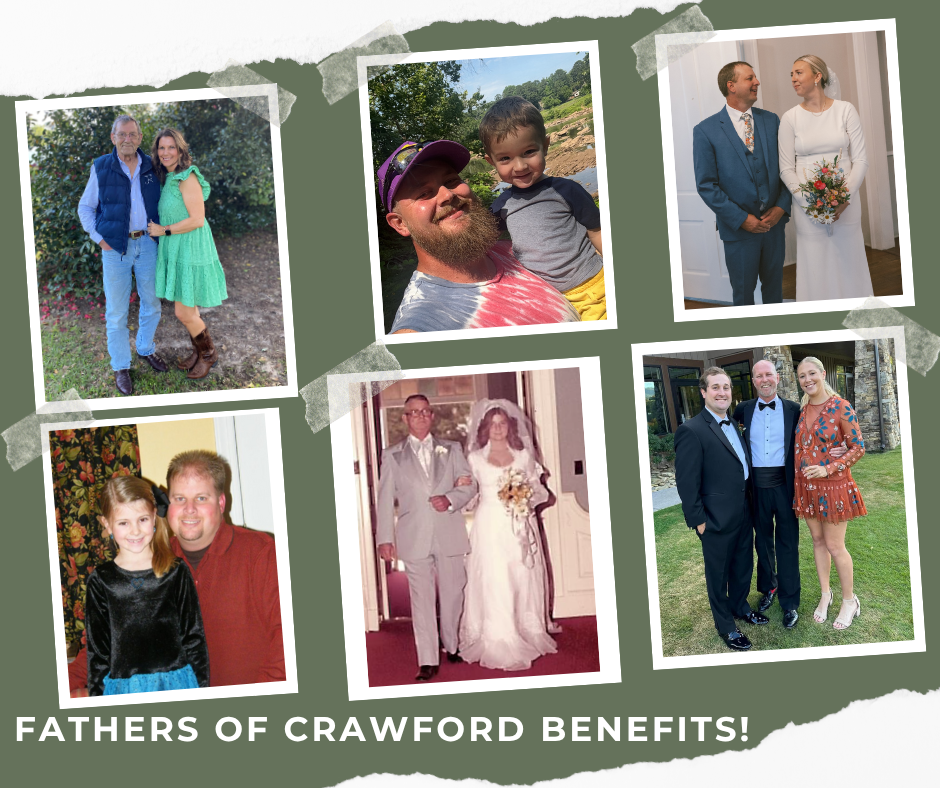

Celebrating the Fathers of Crawford Benefits

This past Father’s Day, we took time to celebrate the incredible dads who are part of our Crawford Benefits family. From team members who balance work and parenting with grace to the fathers who raised us and shaped our values. This month’s spotlight is all about appreciation. Family has always been at the heart of what we do, and honoring the people who support us both at home and at work is something we’re proud to share.

We’ve included a photo from our office of the dads who help make Crawford Benefits what it is today. Their stories, dedication, and leadership continue to inspire our team and our clients every day. Take a moment to check it out you might just spot a familiar face or two.

Reminder: Let Us Know About Income Changes

If your household income has recently changed, now is the time to update your application. Even small shifts in income can impact your eligibility for tax credits or affect the cost of your current health plan. Letting us know early can help prevent issues like overpayment or having to reconcile unexpected costs during tax season.

Many people don’t realize that waiting too long to update their information can result in unexpected tax consequences. Our goal is to help you avoid those headaches with a simple, proactive reminder. Just give us a quick call or send an email we’ll take care of the rest and make sure your coverage stays accurate.

Summer Recipes to Savor

🍉 Watermelon Lemonade

The ultimate summer sip cool, fruity, and just the right balance of sweet and tart.

👉

Get the recipe

🥗 Summer Salad with Fruit

This salad is fresh, colorful, and full of texture. It’s perfect as a light lunch or side.

👉

Try it here

Thanks for Reading!

We're always glad to help you stay informed and covered. Have a question or a topic you'd love to see next month?

Email us at info@michellecrawfordbenefits.com.

If you need help with your policy, coverage options, or anything else just reach out. We're here for you!