What is a Medicare Broker?

Independent Medicare Insurance Brokers – Who are they and what is it going to cost me?

At Crawford Benefits, we are Medicare insurance brokers. We are appointed with all major Medicare carriers so that we can give you unbiased advice on your Medicare plan options. As your agent, we will review all of the options available and recommend a plan that most closely fits your individual needs and budget.

What’s the benefit of using Crawford Benefits as your Medicare insurance broker?

Crawford Benefits provides personal back-end policy support that you do not get directly from an insurance company. Instead of you gaining frustration on the phone with insurance carriers and automated systems, we make the calls to help you with very common Medicare hiccups which can be otherwise stressful for you.

We help our clients daily with billing errors, Medicare appeals, solving pharmacy exceptions when they can’t get their medication, file claims, and so much more. We can interpret communications that you receive from Medicare or your carrier if you have questions. While every situation is different and we can’t guarantee outcomes, we are able to resolve many issues and offer policy assistance to our clients every day.

We also often provide simple and easy education to you about how Medicare works. Every year, thousands of Medicare beneficiaries feel frustrated after trying to read the Medicare handbook. At Crawford Benefits, we will educate you by breaking Medicare down into pieces that are easier to understand.

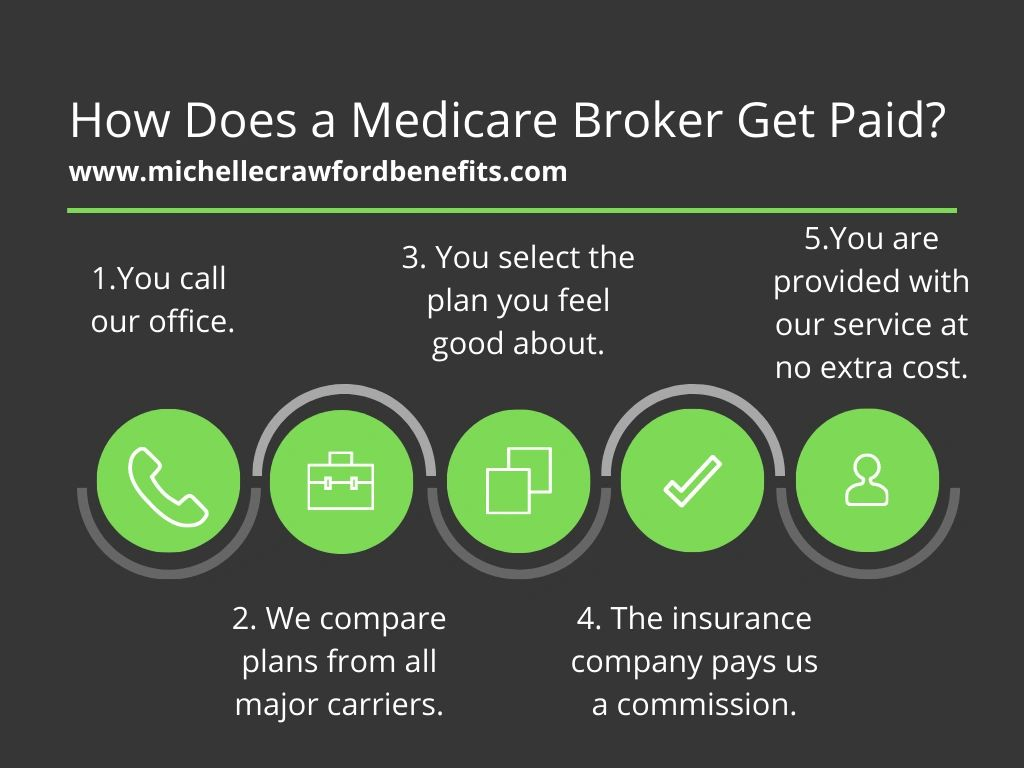

What is the cost of using a Medicare insurance agent?

The good news is in most cases we are paid by the carriers to service your plan*. You pay exactly the same rate for your insurance if you use us as your Medicare consultant/broker. This means in most cases, you pay ABSOLUTELY NOTHING for our help. Because we are contracted with all the major carriers, we are not incentivized by commissions, but focus solely on meeting the needs of our clients.

*We do reserve the right to obtain a minimal consulting fee in the event an insurance carrier will not compensate our agents. If we foresee this situation, our clients are informed of this fee prior to meeting with us.

Where is Crawford Benefits located and how can I make an appointment?

Crawford Benefits is an established agency operating at 2223 Brookstone Centre Parkway, Suite A, Columbus, Georgia 31904. We have two active agents as well as a support staff. We operate Monday – Friday and are accessible via phone, email, or in person. Our top priority is you, our client. We protect our time and our client base by not over-extending in order to give you the personal attention you deserve. Our agents know and care about our clients. We learn about your personal experience, your families, and your needs. When you choose Crawford Benefits as your Medicare agent, you will have someone by your side every step of the way not only during enrollment periods, but year-round. We would love the opportunity to meet you in person or over the phone. You can schedule a consultation on our website or by calling 706-257-5073. We look forward to partnering with you for your future insurance needs.

Oh, and we love referrals!